37+ mortgage interest rate tax deduction

15 2017 you can only deduct. If you are married filing separately you can only deduct.

What Expenses Can Be Deducted From Capital Gains Tax

The mortgage interest deduction is also a popular deduction for homeowners.

. However higher limitations 1 million 500000 if married. Taxes and fees are. Discover How HR Block Makes It Easier to File Your Way.

Come tax time you would use the rental income and expenses. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Standard deduction rates are as follows.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65. Ad Learn How Simple Filing Taxes Can Be. Web You paid 4800 in.

Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

693751 or more. 12950 for tax year 2022. Web My housemate and I both the legal owners of our house pay mortgage expenses from our joint account.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. The good news if you have a bigger mortgage is. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web You might refinance from a 30-year fixed-rate mortgage with an interest rate of 6 to a new 30-year loan with a lower rate of 45. The mortgage interest deduction is simply a tax deduction for the interest paid on your mortgage payment.

Taxpayers in the 37 tax bracket for. Web Most homeowners can deduct all of their mortgage interest. Taxes Can Be Complex.

Web tax returns with itemized deductions Internal Revenue Service 2022. Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. Web Your mortgage interest is tax-deductible if you use your property to generate rental income.

Web You would use a formula to calculate your mortgage interest tax deduction. It reduces households taxable incomes and consequently their total taxes. MIDs value to taxpayers depends on their marginal tax rate.

Single taxpayers and married taxpayers who file separate returns. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are.

Or you might refinance a 30. Web Here is an example of what will be the scenario to some people. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. Start Today to File Your Return with HR Block.

Web Mortgage Interest. Web Web 1 day agoA 15-year fixed-rate mortgage refinance of 300000 with todays interest rate of 637 will cost 2592 per month in principal and interest. File Online or In-Person Today.

Compare offers from our partners side by side and find the perfect lender for you. Ad Discover Rates From Lenders Based On Your. Homeowners who bought houses before.

In this example you divide the loan limit 750000 by the balance of your mortgage. Web Beranda 37 deduction interest standard. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

Web A 20-year fixed-rate mortgage refinance of 300000 with todays interest rate of 698 will cost 2322 per month in principal and interest. You can deduct the interest you pay on your mortgage up. You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately.

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web How to Claim the Home Mortgage Interest Deduction.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Truth Exposed The Dirty Cpf Hdb Scheme To Trick Singaporeans The Heart Truths

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Mortgage Interest Tax Deduction What You Need To Know

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Tax Benefits Of Owning A Home

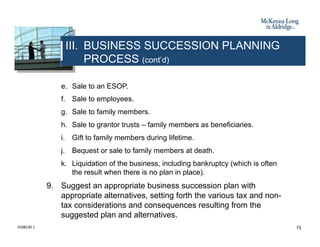

Business Succession Planning And Exit Strategies For The Closely Held

Maximum Mortgage Tax Deduction Benefit Depends On Income

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Form20220323investorconf

Business Succession Planning And Exit Strategies For The Closely Held

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News